-

Welcome to Baptist Board, a friendly forum to discuss the Baptist Faith in a friendly surrounding.

Your voice is missing! You will need to register to get access to all the features that our community has to offer.

We hope to see you as a part of our community soon and God Bless!

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

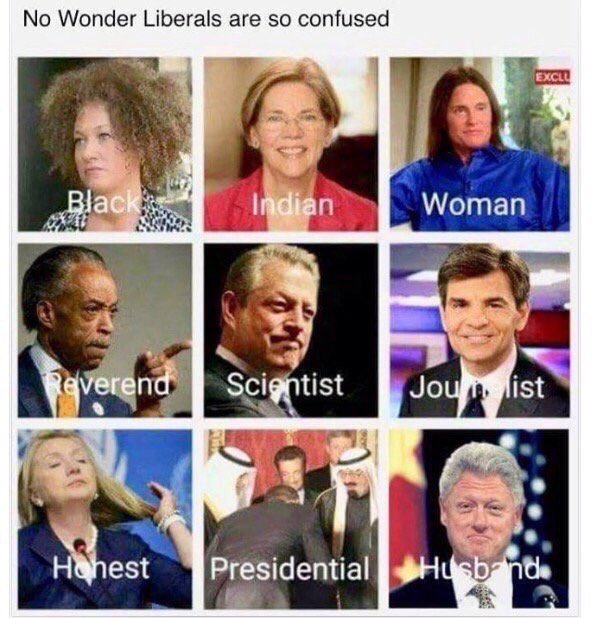

No wonder liberals are confused...

- Thread starter carpro

- Start date

Religion is constant part of Elizabeth Warren’s life

Warren shifted her focus to Matthew 25:40 — and Jesus.

“Inasmuch as ye have done it unto one of the least of these my brethren, ye have done it unto me,” Warren said, quoting the Gospel. Then she shared her interpretation: “He’s saying to us, first, there’s God in every one of us, there’s Jesus in every one of us — however you see it in your religion, that inside there’s something holy in every single person.”

Warren shifted her focus to Matthew 25:40 — and Jesus.

“Inasmuch as ye have done it unto one of the least of these my brethren, ye have done it unto me,” Warren said, quoting the Gospel. Then she shared her interpretation: “He’s saying to us, first, there’s God in every one of us, there’s Jesus in every one of us — however you see it in your religion, that inside there’s something holy in every single person.”

Bruce Jenner identifies himself as a Conservative Republican.

BRUCE JENNER: I’m a transgender, Conservative Republican

BRUCE JENNER: I’m a transgender, Conservative Republican

There is something Un-Holy in most Democrats.Religion is constant part of Elizabeth Warren’s life

Warren shifted her focus to Matthew 25:40 — and Jesus.

“Inasmuch as ye have done it unto one of the least of these my brethren, ye have done it unto me,” Warren said, quoting the Gospel. Then she shared her interpretation: “He’s saying to us, first, there’s God in every one of us, there’s Jesus in every one of us — however you see it in your religion, that inside there’s something holy in every single person.”

View attachment 1730

Bruce Jenner identifies himself as a Conservative Republican.

BRUCE JENNER: I’m a transgender, Conservative Republican

He's a freak. Doesn't know who he is or where he belongs.

Oh, wait. You said liberals, not libertarians. LOL.

Well, looks like we have a New Age minister here!Religion is constant part of Elizabeth Warren’s life

Warren shifted her focus to Matthew 25:40 — and Jesus.

“Inasmuch as ye have done it unto one of the least of these my brethren, ye have done it unto me,” Warren said, quoting the Gospel. Then she shared her interpretation: “He’s saying to us, first, there’s God in every one of us, there’s Jesus in every one of us — however you see it in your religion, that inside there’s something holy in every single person.”

View attachment 1730

I wonder a great deal about the faith of Republicans who want to start more meaningless wars, increase defense spending, take away healthcare from the needy, cut the taxes on the rich and raise them on the middle class, increase inequality, etc. I think they're mostly hypocrites.There is something Un-Holy in most Democrats.

Last edited:

Just sick of asking you to provide a name of a Republican that wants to increase taxes on the middle class but I can't let this go unchallenged. So for the umpteenth time, do you have a name?I wonder a great deal about the faith of Republicans who want to start more meaningless wars, increase defense spending, take away healthcare from the needy, cut the taxes on the rich and raise them on the middle class, increase inequality, etc. I think they're mostly hypocrites.

Also, wonder about the faith of Democrats that are pro abortion, pro same sex marriage, and believe in government as the conduit for charity via taxing people and giving taxpayer money to causes some vehemently object to for religious reasons.

Sent from my Motorola Droid Turbo.

Just sick of asking you to provide a name of a Republican that wants to increase taxes on the middle class but I can't let this go unchallenged. So for the umpteenth time, do you have a name?

Also, wonder about the faith of Democrats that are pro abortion, pro same sex marriage, and believe in government as the conduit for charity via taxing people and giving taxpayer money to causes some vehemently object to for religious reasons.

Sent from my Motorola Droid Turbo.

Why bother asking? It's obvious what FTW is. You're just feeding it.

I think your above statement is 99% dishonest.I wonder a great deal about the faith of Republicans who want to start more meaningless wars, increase defense spending, take away healthcare from the needy, cut the taxes on the rich and raise them on the middle class, increase inequality, etc. I think they're mostly hypocrites.

Of course. Look at the details of both the Trump tax plan and Paul Ryan. This idea is also embedded in McConnell's lies.Just sick of asking you to provide a name of a Republican that wants to increase taxes on the middle class but I can't let this go unchallenged. So for the umpteenth time, do you have a name?

Also, wonder about the faith of Democrats that are pro abortion, pro same sex marriage, and believe in government as the conduit for charity via taxing people and giving taxpayer money to causes some vehemently object to for religious reasons.

Sent from my Motorola Droid Turbo.

Behind the Rhetoric of Trump’s and Congressional Republicans’ Tax Plans - Center for American Progress

"The richest 1 percent get an even larger share of the tax cuts in the House majority’s “A Better Way” proposal. In fact, the wealthiest Americans would receive virtually all of the net tax cuts when the plan is fully phased in. Figure 1 compares recent plans from Trump and the House majority, illustrating that they are both badly skewed to the top 1 percent—and indeed, to the top 0.1 percent—according to TPC."

The reason that the Trump administration and House majority plans are so heavily skewed is that nearly all of their major elements benefit the wealthy either disproportionately or exclusively. Core elements of both plans include:

- Cutting the highly progressive corporate tax from its current level of 35 percent to either 20 percent in the House majority’s plan or 15 percent in Trump’s plan

- Moving to a territorial tax system under which multinational corporations based in the United States would pay no U.S. tax on profits they book overseas

- Carving out a new loophole for so-called passthrough business income, which would predominantly benefit millionaire business owners such as President Trump

- Eliminating the alternative minimum tax, an anti-loophole backstop paid predominantly by high-income individuals

- Eliminating the tax on estates of more than $5.5 million for single filers and $11 million for couples

- Eliminating taxes on high-income individuals enacted in the Affordable Care Act—though it is uncertain at this point whether the majority in Congress will seek to repeal these taxes as part of its tax overhaul

What will really hurt most Americans is cuts in services like medical care and food.

Massive tax cuts will put middle-class bedrocks such as Medicare, Medicaid, and Social Security at risk

Trump and congressional leaders probably will not provide much information about how they intend to pay for their proposed tax cuts. It is critical, however, that they explain their funding mechanism, as the tax cuts outlined in Trump’s April 26 plan total a staggering $7.8 trillion over 10 years and would cost at least $3.5 trillion once potential revenue-raising provisions are taken into account, according to TPC. The Institute for Taxation and Economic Policy estimates that the most plausible version of Trump’s plan would cost $4.8 trillion over 10 years, also taking into account the revenue-raising provisions that Trump and the House majority have proposed, including eliminating the state and local tax deduction. The House majority’s “A Better Way” plan costs $3.1 trillion over 10 years on net.* These staggering sums are all the more concerning because Trump and House leaders have already ruled out most of the major, revenue-raising reforms that could contribute to offsetting tax cuts of those magnitudes.

Working families are left in the dark about how the plan will affect them

The Trump administration has pointedly refused to guarantee that middle-class and working families will not see their taxes rise under its plan, even as the wealthy get large tax cuts. And its plan lacks important details without which it is impossible for any family to gauge how the plan affects them. But there is a fundamental equation at work, which is that any tax plan that provides tax cuts for the wealthy and corporations must also do one of three things:

- Cut programs that people rely on

- Increase deficits

- Raise taxes on people who are not wealthy

What have you or the Republican Party proposed to help the poor?Religion is constant part of Elizabeth Warren’s life

Warren shifted her focus to Matthew 25:40 — and Jesus.

“Inasmuch as ye have done it unto one of the least of these my brethren, ye have done it unto me,” Warren said, quoting the Gospel. Then she shared her interpretation: “He’s saying to us, first, there’s God in every one of us, there’s Jesus in every one of us — however you see it in your religion, that inside there’s something holy in every single person.”

View attachment 1730

The plans will lead to more failed trickle-down economics

Finally, Trump and congressional leaders will likely market their tax cuts using familiar trickle-down theories. For example, they and allied lobbying groups are likely to argue that cutting taxes on “job creators” boosts the economy, or that cutting corporate taxes trickles down to workers. These claims are not to be believed. Recent experience with top tax rates has provided a natural experiment. President Bill Clinton raised the top tax rate substantially in 1993, and the economy subsequently boomed. President George W. Bush cut the tax rate in 2001, and the economy experienced weak growth followed by a crash. President Barack Obama restored the Clinton-era top rate in 2013, and the economy has continued to grow despite the doomsday predictions of anti-tax conservatives. This experience does not prove that raising taxes on the rich leads to better growth or that cutting them slows growth, but it certainly provides evidence that the reverse is not true. Indeed, as economist Jared Bernstein has found, the U.S. experience since World War II shows no correlation between the top marginal tax rate and per-capita economic growth or growth in employment, capital investment, productivity, or pretax median family incomes. A comprehensive review of the economic research on tax cuts and growth by the Brookings Institution’s William Gale and Dartmouth College’s Andrew Samwick concludes that tax cuts are unlikely to have a substantial positive impact on growth and that deficit-financed tax can harm growth. Nor is cutting corporate rates or allowing tax-free repatriation of profits likely to create jobs or boost incomes.

Recent state-level experience also provides cautionary tales for proponents of trickle-down economics. In 2012, California raised taxes on the highest earners—single filers earning more than $250,000 and couples earning more than $500,000—making the top-bracket income tax rates the highest in the nation. That same year, Kansas approved a major tax cut skewed to the top earners and business owners, in what Gov. Sam Brownback (R) called a “real live experiment” in supply-side tax policy. Since then, California has enjoyed among the strongest economic growth of any state, while Kansas has lagged behind the nation and neighboring states in economic growth and jobs. Kansas’ tax cuts have severely worsened the state’s fiscal situation, resulting in deep cuts to education and other state services. Kansas-style tax cuts at the federal level are more likely to repeat this failed experiment than to trickle down to workers in the form of jobs and higher incomes.

Finally, Trump and congressional leaders will likely market their tax cuts using familiar trickle-down theories. For example, they and allied lobbying groups are likely to argue that cutting taxes on “job creators” boosts the economy, or that cutting corporate taxes trickles down to workers. These claims are not to be believed. Recent experience with top tax rates has provided a natural experiment. President Bill Clinton raised the top tax rate substantially in 1993, and the economy subsequently boomed. President George W. Bush cut the tax rate in 2001, and the economy experienced weak growth followed by a crash. President Barack Obama restored the Clinton-era top rate in 2013, and the economy has continued to grow despite the doomsday predictions of anti-tax conservatives. This experience does not prove that raising taxes on the rich leads to better growth or that cutting them slows growth, but it certainly provides evidence that the reverse is not true. Indeed, as economist Jared Bernstein has found, the U.S. experience since World War II shows no correlation between the top marginal tax rate and per-capita economic growth or growth in employment, capital investment, productivity, or pretax median family incomes. A comprehensive review of the economic research on tax cuts and growth by the Brookings Institution’s William Gale and Dartmouth College’s Andrew Samwick concludes that tax cuts are unlikely to have a substantial positive impact on growth and that deficit-financed tax can harm growth. Nor is cutting corporate rates or allowing tax-free repatriation of profits likely to create jobs or boost incomes.

Recent state-level experience also provides cautionary tales for proponents of trickle-down economics. In 2012, California raised taxes on the highest earners—single filers earning more than $250,000 and couples earning more than $500,000—making the top-bracket income tax rates the highest in the nation. That same year, Kansas approved a major tax cut skewed to the top earners and business owners, in what Gov. Sam Brownback (R) called a “real live experiment” in supply-side tax policy. Since then, California has enjoyed among the strongest economic growth of any state, while Kansas has lagged behind the nation and neighboring states in economic growth and jobs. Kansas’ tax cuts have severely worsened the state’s fiscal situation, resulting in deep cuts to education and other state services. Kansas-style tax cuts at the federal level are more likely to repeat this failed experiment than to trickle down to workers in the form of jobs and higher incomes.

I wonder a great deal about the faith of Republicans who want to start more meaningless wars,

There are no Republicans who want to do this.

increase defense spending,

So you question the salvation of those who want to keep this country safe? Please show me the scripture to support that.

take away healthcare from the needy,

which Republican said those words?

cut the taxes on the rich

Why are the rich a constant target of tax confiscation for the far left?

and raise them on the middle class,

There are no Republicans who want to do this.

increase inequality,

What is wrong with inequality? Why should we question the faith of someone who supports this? What passage of scripture says we should never support financial inequality on a national scale?

etc. I think they're mostly hypocrites.

Do you know what that word means? I only ask because you finished off this post with that accusation but showed nothing in the rest of the post to substantiate that. Of course nothing in this post is substantiated. It's all hyperbole and vitriol.

Of course. Look at the details of both the Trump tax plan and Paul Ryan. This idea is also embedded in McConnell's lies.

Behind the Rhetoric of Trump’s and Congressional Republicans’ Tax Plans - Center for American Progress

"The richest 1 percent get an even larger share of the tax cuts in the House majority’s “A Better Way” proposal. In fact, the wealthiest Americans would receive virtually all of the net tax cuts when the plan is fully phased in. Figure 1 compares recent plans from Trump and the House majority, illustrating that they are both badly skewed to the top 1 percent—and indeed, to the top 0.1 percent—according to TPC."

Nope, not seeing a tax increase on the middle class.

Is not individual tax rates.The reason that the Trump administration and House majority plans are so heavily skewed is that nearly all of their major elements benefit the wealthy either disproportionately or exclusively. Core elements of both plans include:

- Cutting the highly progressive corporate tax from its current level of 35 percent to either 20 percent in the House majority’s plan or 15 percent in Trump’s plan

- Moving to a territorial tax system under which multinational corporations based in the United States would pay no U.S. tax on profits they book overseas

This idea has been abandoned and anyway, is not individual tax rates.

This idea has been abandoned.

None of this increases taxes on middle class taxpayers.

AHA! Well, looky there....it says that taxes will be reduced on the middle class.

Argument ends...my point that no Republican is calling for tax increases on the middle class is shown by your own so-called rebuttal.

- Carving out a new loophole for so-called passthrough business income, which would predominantly benefit millionaire business owners such as President Trump

This idea has been abandoned.

- Eliminating the alternative minimum tax, an anti-loophole backstop paid predominantly by high-income individuals

- Eliminating the tax on estates of more than $5.5 million for single filers and $11 million for couples

- Eliminating taxes on high-income individuals enacted in the Affordable Care Act—though it is uncertain at this point whether the majority in Congress will seek to repeal these taxes as part of its tax overhaul

None of this increases taxes on middle class taxpayers.

Reducing individual tax rates, as the plans introduced by both Trump and the House majority have proposed, also benefits the wealthy more than middle- and lower-income families.

AHA! Well, looky there....it says that taxes will be reduced on the middle class.

Argument ends...my point that no Republican is calling for tax increases on the middle class is shown by your own so-called rebuttal.

The plans will lead to more failed trickle-down economics

Finally, Trump and congressional leaders will likely market their tax cuts using familiar trickle-down theories. For example, they and allied lobbying groups are likely to argue that cutting taxes on “job creators” boosts the economy, or that cutting corporate taxes trickles down to workers. These claims are not to be believed. Recent experience with top tax rates has provided a natural experiment. President Bill Clinton raised the top tax rate substantially in 1993, and the economy subsequently boomed.

Sorry, but no rewriting of history here. The economy in the 1990's didn't boom until after the Republicans lowered taxes on the middle class in the "Contract with America", after welfare was reformed, and government spending in general was reduced. Also, the 1990's was the time of the internet dot.com boom which fueled the economy and had nothing to do with tax policy.

President George W. Bush cut the tax rate in 2001, and the economy experienced weak growth followed by a crash.

Ummm....9/11? Remember 9/11? Had a little effect on the economy. Starting in about 2003 the economy was producing decent numbers for about four years in a row.

Average annual GDP growth:

2003 2.8%

2004 3.8%

2005 3.4%

2006 2.8%

Obama NEVER had a year with 3.0% or greater average annual GDP growth.

President Barack Obama restored the Clinton-era top rate in 2013, and the economy has continued to grow despite the doomsday predictions of anti-tax conservatives. This experience does not prove that raising taxes on the rich leads to better growth or that cutting them slows growth, but it certainly provides evidence that the reverse is not true.

Well, at least the writer is honest in this section. Where was this honesty when he claimed the economy boomed after Clinton raised taxes? You have a contradiction in your own argument!

And it will now be repeated:

In 2012, California raised taxes on the highest earners—single filers earning more than $250,000 and couples earning more than $500,000—making the top-bracket income tax rates the highest in the nation. Since then, California has enjoyed among the strongest economic growth of any state

Ummm...Drought? Remember the droughts in California? Had a little, teensy, weensy effect on the economy.

Also, California having the strongest economic growth of any state is debateable, but even if were true, it was because it had so severely bottomed out that any increase in the economy would appear to be boom times.

Last edited:

We, the members of our church, fed 147 families this week. What have you done?What have you or the Republican Party proposed to help the poor?